Merchant Cash Advance: Understanding This Fast-Track Funding Option for E-commerce

As an e-commerce business owner, you may find yourself needing quick access to capital for inventory purchases, marketing campaigns, or unexpected opportunities. A Merchant Cash Advance (MCA) represents one of the fastest ways to access business funding, though it comes with its own set of considerations.

What is a Merchant Cash Advance?

A Merchant Cash Advance is not a loan but rather a purchase of your future sales. The provider gives you an upfront sum in exchange for a percentage of your daily or weekly sales until the agreed-upon amount is repaid. For e-commerce businesses, this typically means a percentage of your daily credit card and digital payment transactions.

How MCAs Work in E-commerce

The Basic Structure

- You receive a lump sum upfront

- The provider takes a fixed percentage of your daily sales

- Payments continue until you’ve repaid the agreed amount plus fees

- The repayment period typically ranges from 3-18 months

Key Components

- Advance Amount: The upfront capital you receive

- Factor Rate: The multiplier determining total repayment (typically 1.2 to 1.5)

- Holdback Rate: The percentage of daily sales taken for repayment (usually 10-20%)

Advantages for E-commerce Businesses

1. Speed of Funding

- Application process often takes hours

- Funding possible within 24-48 hours

- Minimal paperwork required

2. Flexible Qualification Requirements

- No collateral needed

- Less emphasis on credit scores

- Focus on sales volume and business performance

3. Automatic Payment Structure

- Payments adjust with your sales volume

- No fixed monthly payments

- Integrated with your payment processing

4. High Approval Rates

- More accessible than traditional bank loans

- Consideration of overall business health

- Less stringent requirements

Ideal Use Cases for MCAs

Inventory Opportunities

- Bulk purchase discounts

- Seasonal stock preparation

- New product line launches

Marketing and Growth

- Digital advertising campaigns

- Website improvements

- Market expansion initiatives

Emergency Needs

- Equipment replacement

- Unexpected expenses

- Cash flow gaps

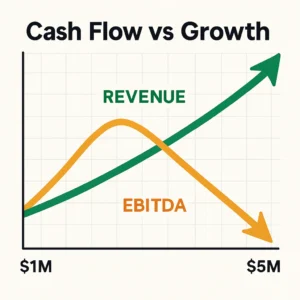

Understanding the Costs

Factor Rate Example

If you receive $100,000 with a factor rate of 1.4:

- Total Repayment = $140,000

- The effective cost is $40,000

- This represents a 40% fee on the advance

Daily Impact

For a $100,000 advance with 15% holdback:

- Daily Sales: $5,000

- Daily Holdback: $750 (15% of $5,000)

- This continues until full repayment

Qualification Requirements

Typical Prerequisites

- Minimum 6 months in business

- $10,000+ in monthly revenue

- Stable sales history

- Valid business bank account

- Clean payment processing history

Potential Drawbacks

1. High Cost

- Factor rates can make this an expensive option

- Effective APR can be significantly higher than traditional loans

- Costs are front-loaded

2. Daily Cash Flow Impact

- Regular payment deductions affect available cash

- Can strain working capital

- May impact ability to cover other expenses

3. Debt Cycle Risk

- Temptation to take another advance before repaying current one

- Can lead to stacking multiple advances

- May create long-term financial strain

Best Practices for Using MCAs

1. Clear Return on Investment

- Calculate expected ROI from the advance

- Ensure the opportunity justifies the cost

- Plan for repayment through increased revenue

2. Read the Fine Print

- Understand all fees and terms

- Check for early repayment options

- Review contract termination conditions

3. Strategic Planning

- Use for specific, revenue-generating purposes

- Have a clear repayment strategy

- Monitor daily cash flow impact

How to Apply

1. Preparation

- Gather recent bank statements

- Prepare processing statements

- Document monthly revenue

- List current business debts

2. Application Process

- Complete online application

- Connect business accounts

- Provide required documentation

- Review and accept offer

3. Post-Funding

- Monitor daily deductions

- Track repayment progress

- Maintain communication with provider

- Plan for business growth

Alternatives to Consider

Before committing to an MCA, consider:

- Revenue-based financing

- Business lines of credit

- Traditional bank loans

- Equipment financing

- Invoice factoring

Conclusion

Merchant Cash Advances can be a valuable tool for e-commerce businesses needing quick access to capital, particularly when traditional financing isn’t available or time is of the essence. However, the high costs and daily repayment structure make it crucial to carefully evaluate whether an MCA aligns with your business model and growth strategy.

Success with MCAs depends on having:

- A clear purpose for the funds

- Strong profit margins

- Stable or growing sales

- A solid repayment strategy

- Understanding of the total cost

Remember that while MCAs can provide quick relief or enable growth opportunities, they should be used strategically and with a clear understanding of how the repayment structure will impact your daily operations. Consider consulting with financial advisors to ensure this funding option aligns with your business goals and capabilities.