In today’s fast-paced e-commerce landscape, traditional financing options often fall short of meeting the unique needs of online businesses. Whether you need capital for inventory, marketing campaigns, or expansion, revenue-based financing (RBF) has emerged as a compelling alternative that’s specifically designed for e-commerce entrepreneurs.

What is Revenue-Based Financing?

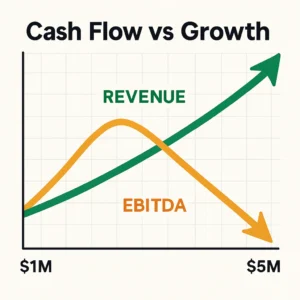

Revenue-based financing is a funding model where you receive capital upfront in exchange for a percentage of your future monthly revenue. Unlike traditional loans with fixed monthly payments, RBF adapts to your business performance – you pay more when sales are high and less when they’re lower. This flexibility makes it particularly attractive for e-commerce businesses with seasonal fluctuations or rapid growth patterns.

Key Benefits for E-commerce Businesses

1. Quick Access to Capital

- Application process typically takes hours, not weeks

- Funding decisions based primarily on revenue data rather than credit history

- Capital can be available within days of approval

2. No Fixed Monthly Payments

- Payments scale with your revenue

- Lower burden during slow seasons

- Higher payments only when your business performs well

3. No Equity Dilution

- Maintain full ownership of your business

- No board seats or control requirements

- Freedom to make strategic decisions independently

4. Data-Driven Approval Process

- Evaluation based on actual business performance

- Integration with e-commerce platforms for real-time data analysis

- Less emphasis on personal credit scores

When RBF Makes Sense for Your Business

Revenue-based financing is particularly suitable when:

- You need quick capital for inventory purchases

- You want to scale marketing campaigns with proven ROI

- You’re experiencing seasonal peaks and need working capital

- You have stable monthly revenues but variable cash flow

- Your margins can support revenue sharing without strain

Understanding the Costs

RBF typically involves:

- A total repayment amount (usually 1.2x to 1.8x the funded amount)

- Revenue share percentage (typically 5-20% of monthly revenue)

- No compounding interest or late fees

- Transparent fee structure with no hidden charges

Real-World Application Examples

Inventory Financing

A fashion e-commerce store receives $100,000 in RBF funding to stock up for the holiday season. They agree to pay 12% of monthly revenue until they’ve repaid $130,000. During peak months, they might pay $12,000 (12% of $100,000 in revenue), while in slower months, they might pay $3,600 (12% of $30,000 in revenue).

Marketing Scale-Up

An electronics retailer uses $50,000 in RBF funding to scale their proven Facebook ad campaigns. With a 10% revenue share agreement and a 1.4x return cap, they can immediately invest in marketing while paying back $70,000 from the incremental revenue generated by the ads.

Potential Drawbacks to Consider

1. Cost of Capital

- Total repayment amounts can be higher than traditional loans

- Effective APR varies based on repayment speed

2. Revenue Share Impact

- Monthly payments can affect cash flow during high-revenue periods

- Need to factor revenue share into profit margins

3. Performance Requirements

- May need to maintain minimum monthly revenue

- Regular financial reporting requirements

Is RBF Right for Your E-commerce Business?

Consider RBF if you:

- Have been in business for at least 6 months

- Generate consistent monthly revenue (typically $10,000+)

- Need capital for growth rather than survival

- Have healthy gross margins (typically 30%+)

- Can verify revenue through connected platforms

How to Get Started

- Gather your business data:

- Monthly revenue for the past 6-12 months

- Current growth rate

- Profit margins

- Expected use of funds

- Compare RBF providers:

- Review revenue share percentages

- Understand total repayment terms

- Check platform integration requirements

- Evaluate additional services offered

- Prepare your application:

- Connect your e-commerce platforms

- Provide access to business bank accounts

- Share marketing metrics if applicable

- Outline your growth plan

Conclusion

Revenue-based financing represents a modern funding solution that aligns well with the dynamics of e-commerce businesses. While it may not be the cheapest form of capital, its flexibility, speed, and alignment with business performance make it an attractive option for growth-focused e-commerce entrepreneurs. Before proceeding, carefully evaluate your business metrics, growth plans, and ability to maintain healthy margins while sharing revenue.

Remember that the best financing choice depends on your specific business situation, growth stage, and objectives. Consider consulting with financial advisors or experienced e-commerce operators who can help you assess whether RBF is the right choice for your business growth strategy.