Navigating the world of e-commerce financing can feel overwhelming for new business owners trying to grow their online presence. With a variety of options like loans, merchant cash advances, and lines of credit available, it’s crucial to understand which choice fits best with your unique business needs. By breaking down the different funding strategies, this guide aims to simplify the decision-making process, empowering you to select the most suitable financial solution. Whether you’re aiming to boost your inventory, invest in marketing, or simply need a safety net for cash flow, having the right financing can make all the difference. Let’s explore these options and transform your e-commerce dreams into reality.

Understanding E-commerce Financing

Beginner’s Guide to Financing

Starting your e-commerce journey involves understanding the financing options available. First, consider traditional business loans, which often offer lower interest rates but require a strong credit history. They are ideal if you have a solid business plan and can meet the bank’s requirements. Alternatively, merchant cash advances provide a lump sum in exchange for a percentage of future sales. They offer quick access to capital but come with higher costs. Lines of credit can act as a financial safety net, providing flexibility to borrow as needed for inventory or marketing. They require regular payments but are useful for managing cash flow. Each option has its nuances, so assess your business needs and financial health. By knowing these basics, you’re better prepared to make informed choices that align with your growth strategy. Explore further to find the best fit for your unique situation.

Exploring Your Options

When it comes to e-commerce financing, a range of options can cater to different business needs. Traditional loans are a popular choice for those with strong credit and a detailed business plan. They often have lower interest rates and longer repayment terms. For fast, flexible funding, merchant cash advances are worth considering. They provide upfront cash in exchange for a share of future sales, ideal for businesses needing quick capital to seize growth opportunities. Lines of credit offer another versatile solution, functioning much like a credit card with a set limit. You borrow as needed and pay interest only on the amount used, making it an excellent tool for managing seasonal fluctuations. Each option has its pros and cons, so it’s crucial to analyze your financial situation and business objectives. Understanding these alternatives will help you identify the most suitable financing strategy for your e-commerce venture.

E-commerce Funding Strategies

Tailored Funding for Your Needs

Choosing the right funding strategy for your e-commerce business involves aligning financial solutions with your specific needs. For businesses looking to expand rapidly, merchant cash advances offer a quick injection of capital without the need for extensive credit checks. They’re suitable for businesses with a high volume of credit card sales. Alternatively, if your business experiences seasonal sales spikes, a line of credit can provide the flexibility to manage cash flow effectively. This option allows you to borrow as needed, paying interest only on the amount used. For those planning long-term investments in infrastructure or technology, traditional business loans could be the best fit. They offer lower interest rates and structured repayment schedules. Each funding option has distinct benefits and considerations. By evaluating your business goals, cash flow patterns, and risk tolerance, you can tailor a funding strategy that supports sustainable growth and addresses your unique challenges.

Choosing the Right Strategy

Selecting the most appropriate funding strategy for your e-commerce business requires a careful assessment of your financial needs and business objectives. Start by defining what you need the funds for—be it increasing inventory, enhancing marketing efforts, or improving infrastructure. If quick turnaround is crucial, a merchant cash advance might be your best bet, offering swift access to capital. However, this comes at a higher cost. For more predictable financial planning, a traditional loan might be suitable, especially if you have a solid credit history. Loans generally offer lower interest rates but involve longer approval processes. If you require ongoing access to funds to manage cash flow, consider a line of credit, which provides flexibility to borrow as needed. Evaluate the costs, terms, and potential impact on your cash flow for each option. By aligning your choice with your business’s specific needs and financial situation, you can ensure a supportive path toward growth.

Loans for E-commerce

Benefits and Drawbacks

Loans for e-commerce businesses offer several advantages, making them a popular choice for many entrepreneurs. One of the primary benefits is the access to a larger sum of money, which can be pivotal for scaling operations, investing in technology, or expanding product lines. Additionally, loans often come with structured repayment terms and lower interest rates compared to other financing options like merchant cash advances. This predictability can aid in financial planning and budgeting. However, there are also drawbacks to consider. The loan approval process can be lengthy and may require a strong credit score and a detailed business plan. Collateral might be needed to secure the loan, which can be risky if the business faces financial difficulties. Furthermore, fixed monthly repayments can strain cash flow, especially during slow sales periods. It’s crucial to weigh these benefits and drawbacks to determine if a loan aligns with your business’s financial strategy and growth objectives.

Selecting the Best Loan

Choosing the right loan for your e-commerce business involves evaluating various factors to ensure it matches your financial needs and goals. Start by identifying the purpose of the loan—whether it’s for expanding inventory, launching a new marketing campaign, or upgrading your technology stack. Once clear on the purpose, compare loan options based on interest rates, terms, and fees. Consider traditional bank loans if you’re seeking lower interest rates and have a solid credit score. They offer structured repayment schedules, which can help with long-term financial planning. For quicker access to funds, online lenders might be more suitable, though they often come with higher rates. Assess the repayment terms carefully; longer terms might mean lower monthly payments but result in more interest over time. Additionally, scrutinize any fees associated with the loan, such as origination or early repayment fees. By aligning the loan’s features with your business needs, you can select a loan that best supports your growth strategy.

Merchant Cash Advances

Supporting Rapid Scaling

Merchant cash advances (MCAs) can be a powerful tool for e-commerce businesses looking to scale rapidly. Unlike traditional loans, MCAs provide a lump sum of cash in exchange for a portion of future sales, making them particularly attractive for businesses with strong sales projections. This funding method offers quick access to capital, often within days, allowing businesses to seize immediate growth opportunities, such as stocking up on inventory before peak sales periods or launching a new product line. The flexibility of repayment, which adjusts according to sales volume, can be beneficial for managing cash flow without the pressure of fixed monthly payments. However, it’s essential to be aware of the high costs associated with MCAs, as they typically carry higher fees than conventional loans. Understanding these dynamics is crucial for leveraging MCAs effectively to support your business’s scaling ambitions while maintaining financial health. Assessing your sales stability and cash flow will help determine if an MCA is a viable option for your growth strategy.

Flexibility for Growth

Merchant cash advances (MCAs) offer a unique flexibility that can be advantageous for e-commerce businesses aiming for growth. Unlike traditional loans, MCAs are repaid through a percentage of daily sales, which means the payment amount fluctuates with your cash flow. This feature can be particularly beneficial during slower sales periods, as it provides relief from the burden of fixed monthly payments. The flexibility of MCAs allows businesses to invest in opportunities as they arise, whether it’s purchasing additional inventory for a busy season or funding a marketing campaign. Additionally, the approval process for MCAs is typically faster and less stringent compared to bank loans, making it accessible even for those with less-than-perfect credit. However, it’s important to consider the higher costs associated with this type of financing. Understanding the balance between flexibility and cost will help you make informed decisions on whether an MCA aligns with your growth strategy and financial goals.

Line of Credit Benefits

Safety Net for Businesses

A line of credit can serve as an essential safety net for e-commerce businesses, providing flexibility and security in managing cash flow. Unlike traditional loans, a line of credit allows businesses to borrow up to a predetermined limit as needed, rather than receiving a lump sum upfront. This access to funds can be crucial for covering unexpected expenses or capitalizing on sudden growth opportunities. For instance, if there’s a surge in demand, a line of credit can help quickly restock inventory without disrupting cash flow. Additionally, you only pay interest on the amount borrowed, making it a cost-effective option compared to other financing methods. This financial tool also helps manage seasonal fluctuations, ensuring operations run smoothly during off-peak periods. However, it’s important to manage this resource wisely to avoid over-reliance. By maintaining prudent borrowing practices, a line of credit can effectively support your business’s stability and growth aspirations.

Fueling Business Expansion

A line of credit is a versatile financial tool that can significantly aid in fueling business expansion for e-commerce enterprises. Its revolving nature allows businesses to access funds repeatedly up to a set limit, making it ideal for pursuing growth initiatives. Whether you’re looking to launch a new product line, enter a new market, or ramp up marketing efforts, a line of credit offers the liquidity needed to execute these plans without draining your reserves. This flexibility enables you to seize expansion opportunities swiftly, as funds are available when you need them, rather than having to undergo a lengthy loan approval process. Moreover, by only paying interest on the amount you draw, a line of credit offers a cost-effective solution compared to fixed-term loans. However, prudent management is crucial to ensure you don’t overextend your financial resources. By strategically leveraging a line of credit, you can support your e-commerce business’s growth trajectory.

Revenue-Based Financing

Advantages and Drawbacks

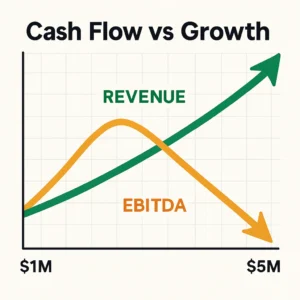

Revenue-based financing (RBF) offers a flexible alternative to traditional funding methods, particularly suited for e-commerce businesses with fluctuating revenue streams. One key advantage of RBF is its repayment structure, which is tied to a percentage of monthly revenue. This means repayments adjust according to business performance, providing relief during slower months and scaling back up during periods of high sales. This adaptability can be a boon for managing cash flow without the stress of fixed monthly payments. Additionally, RBF does not require equity dilution, allowing you to retain full control over your business. However, there are drawbacks to consider. The cost of capital can be higher than traditional loans due to the risk taken by the lender. Additionally, RBF might not be suitable for businesses with low or inconsistent sales, as repayments are directly linked to revenue. Evaluating these factors is crucial to determine if RBF aligns with your financial strategy and business model.

Suitability for E-commerce

Revenue-based financing (RBF) is particularly well-suited for e-commerce businesses that experience variable income streams or seasonal sales patterns. This financing model aligns repayments with business performance, making it ideal for companies whose revenues fluctuate month-to-month. E-commerce businesses that plan to expand their product lines or ramp up marketing efforts can benefit from RBF’s flexibility without the burden of fixed repayments. Since repayments are a percentage of monthly revenue, businesses face less financial strain during off-peak periods, which can help maintain cash flow stability. However, RBF is best suited for businesses with a proven sales track record, as future revenues are used as the basis for funding. It may not be the best option for startups or those with unpredictable sales volumes, as it requires a certain level of revenue consistency. By matching the repayment plan with revenue cycles, RBF can support sustainable growth for established e-commerce ventures.

Data-Driven Funding with Turbodash

Streamlining Funding Decisions

Turbodash harnesses the power of data analytics to simplify and expedite funding decisions for e-commerce businesses. By using advanced algorithms, Turbodash evaluates multiple financing options in real-time, helping businesses identify the best solutions tailored to their financial needs and growth objectives. This data-driven approach ensures that entrepreneurs receive personalized recommendations based on their business performance and market conditions. With Turbodash, the cumbersome process of comparing numerous funding options becomes straightforward, saving valuable time and effort. It provides insights into the costs, benefits, and terms of each option, allowing business owners to make informed decisions quickly and confidently. Furthermore, Turbodash’s platform offers transparency, reducing the risk of hidden fees and unfavorable terms. By leveraging data to streamline funding decisions, Turbodash empowers e-commerce businesses to secure the right financial support, enabling them to focus on growth and innovation without the stress of navigating complex financing landscapes.

Quick and Transparent Process

Turbodash offers a quick and transparent process that simplifies securing funding for e-commerce businesses. By leveraging cutting-edge technology, Turbodash enables business owners to navigate funding options efficiently. The platform uses a user-friendly interface to collect key business information, providing instant access to a curated selection of financing solutions tailored to your specific needs. This streamlined process eliminates the traditional delays associated with loan applications and approvals. Each financing option is presented with clear terms and conditions, allowing you to make informed choices without the stress of hidden costs or complex jargon. Turbodash ensures transparency, allowing you to compare interest rates, repayment terms, and fees upfront. This clarity empowers you to choose the best financial route with confidence. By combining speed with transparency, Turbodash not only saves time but also empowers e-commerce entrepreneurs to focus on scaling their businesses, knowing they have the right financial support in place.

Fast Tracking Funding Searches

Reducing Search Time

Turbodash significantly reduces the time spent searching for suitable funding by providing a streamlined, efficient process. Traditional methods of securing financing often involve extensive research, numerous applications, and prolonged waiting periods, which can be both tiring and time-consuming. Turbodash addresses this challenge by using advanced algorithms to quickly analyze your business’s financial data and match it with the most relevant funding options available. This automated process eliminates the need to manually sift through countless lenders and terms, allowing you to focus more on your business operations. Additionally, Turbodash’s platform presents financing solutions with clear, concise information, enabling you to make swift, informed decisions without the hassle of back-and-forth negotiations. By drastically cutting down search time from days to mere minutes, Turbodash not only increases efficiency but also provides a competitive edge, empowering businesses to seize growth opportunities with the assurance that they have reliable financial support ready when needed.

Turbocharging Your Business

Turbodash turbocharges your business by streamlining the funding process, allowing you to focus on growth and innovation. With its efficient platform, Turbodash quickly connects you with the right financing solutions tailored to your business’s unique needs. This swift access to capital means you can respond promptly to market opportunities, such as launching new products, expanding into new markets, or boosting marketing efforts. The platform’s ability to provide clear, upfront information on financing options empowers you to make swift, informed decisions without getting bogged down in complex details. By removing the traditional barriers of time-consuming searches and lengthy application processes, Turbodash enables you to allocate more resources towards strategic initiatives that drive business success. Whether you’re looking to enhance your product offerings or scale operations, Turbodash ensures that you have the financial backing to execute your plans effectively. With Turbodash, your business is equipped to navigate the competitive landscape with agility and confidence.

Navigating Financing Options

Simplifying the Search

Navigating the array of financing options available to e-commerce businesses can be daunting, but simplifying this search is crucial for making efficient and effective decisions. Start by clearly defining your business needs, such as whether you require funds for inventory, marketing, or infrastructure improvements. Once your needs are outlined, focus on financing options that align with your goals. Utilize tools and platforms that provide comprehensive comparisons of different funding solutions, such as interest rates, repayment terms, and fees. These resources can save you significant time and effort by consolidating relevant information in one place. Additionally, consider consulting with financial advisors who specialize in e-commerce to gain insights tailored to your business model. By approaching the search process methodically, you can eliminate unsuitable options early, streamline your decision-making, and focus on solutions that truly match your business’s financial objectives. This strategic approach will empower you to secure the best financing to support your growth ambitions.

Comprehensive Guide to Options

A comprehensive guide to financing options is essential for e-commerce businesses seeking the right funding solutions. Begin by exploring traditional business loans, which offer lower interest rates and structured repayment plans, suitable for businesses with a strong credit history. Next, consider merchant cash advances for quick capital access, albeit at a higher cost, ideal for businesses with consistent sales volumes. Lines of credit provide flexibility, allowing you to borrow as needed and pay interest only on the drawn amount, which is beneficial for managing seasonal cash flow fluctuations. Additionally, revenue-based financing ties repayments to monthly income, offering a flexible alternative that grows with your business. Each option has unique benefits and potential drawbacks. It’s vital to evaluate these based on your business model, financial health, and growth plans. Using a detailed guide, you can systematically assess each option, ensuring you choose the most suitable financing to support your e-commerce business’s goals and challenges.

Overcoming Financial Barriers

Addressing Common Challenges

E-commerce businesses often face financial challenges that can hinder growth and stability. Cash flow management is a primary concern, especially for businesses with fluctuating sales patterns. To address this, consider using lines of credit, which offer flexible borrowing to help manage short-term cash needs. Another common challenge is securing funding with less-than-perfect credit. Alternative financing options like merchant cash advances or revenue-based financing can provide access to capital without stringent credit requirements. Additionally, businesses may struggle with unexpected expenses or inventory costs, which can disrupt financial planning. Establishing an emergency fund or negotiating better terms with suppliers can mitigate these issues. It’s also crucial to maintain accurate financial records and forecasts to anticipate potential challenges and make informed decisions. By understanding and addressing these common barriers, e-commerce businesses can implement strategies that build financial resilience, ensuring they are better equipped to navigate the complexities of the market and drive sustainable growth.

Tailored Solutions and Advice

To overcome financial barriers, e-commerce businesses need tailored solutions and expert advice that align with their specific needs and challenges. Start by conducting a thorough assessment of your financial health, identifying key areas that require attention, such as cash flow management or debt reduction. Seek advice from financial advisors who specialize in e-commerce, as they can provide customized strategies for optimizing your financial operations. Consider implementing technology solutions, like automated accounting software, to streamline financial management and enhance accuracy. Tailored financing options, such as revenue-based financing or lines of credit, can also offer flexibility and support for your business model. Additionally, negotiating with suppliers for favorable payment terms can improve cash flow and reduce financial strain. Regularly review and adjust your financial strategies to adapt to changing market conditions. By leveraging tailored solutions and expert advice, you can effectively address financial barriers, enabling your business to thrive and pursue growth opportunities confidently.

Optimizing E-commerce Funding

Practical Tips for Owners

E-commerce business owners can optimize funding by implementing practical strategies that enhance financial management and support growth. First, maintain detailed and accurate financial records to provide clarity on your business’s cash flow and funding needs. This information is crucial when seeking financing, as it demonstrates financial responsibility to potential lenders. Next, explore diverse funding options to find the best fit for your business. Traditional loans, lines of credit, and alternative financing such as merchant cash advances each have their own advantages and should be considered based on your specific requirements. Additionally, build strong relationships with financial institutions and investors by maintaining open communication and demonstrating your business’s potential. Regularly assess your funding strategy and adjust it as your business evolves. Finally, focus on improving your credit score, as it can impact your access to favorable financing terms. By adopting these practical tips, e-commerce owners can effectively manage funding and drive their businesses toward sustained success.

Maximizing Funding Effectiveness

To maximize the effectiveness of funding in your e-commerce business, it’s essential to strategically allocate resources and make informed financial decisions. Start by clearly defining your business goals and aligning funding with these objectives. Whether it’s expanding product lines, enhancing marketing efforts, or improving technology, ensure that each dollar spent contributes to achieving these targets. Monitor your return on investment (ROI) closely to evaluate the impact of funding on business growth. Use financial metrics to track performance and adjust strategies as needed. Additionally, prioritize expenses that offer the highest potential for growth and scalability. Regularly review and optimize your budget to eliminate inefficiencies and reduce unnecessary costs. Engaging with financial advisors or consultants can provide valuable insights and help refine your funding strategy. By focusing on strategic allocation and continuous assessment, you can ensure that the capital you secure is used effectively to drive sustained business success and expansion.

Inside Look at E-commerce Loans

Understanding Loan Types

Understanding the different types of loans available for e-commerce businesses is crucial for making informed financial decisions. Traditional bank loans are a common choice, offering lower interest rates and longer repayment terms, but they often require strong credit and a detailed business plan. These loans are suitable for established businesses with predictable income streams. For quicker access to funds, consider online lenders who offer short-term loans. These typically have higher interest rates but are easier to obtain with flexible qualification criteria. Another option is equipment financing, which allows you to purchase or lease necessary equipment with the equipment itself serving as collateral. This type of loan is beneficial for businesses looking to invest in new technology or infrastructure. Lastly, consider Small Business Administration (SBA) loans, which are government-backed and offer favorable terms, though they can involve a lengthy application process. By understanding these loan types, you can select the most appropriate option for your business’s needs.

Discovering Loan Benefits

Exploring the benefits of e-commerce loans can help business owners make strategic financial decisions that support growth and sustainability. One of the primary benefits is access to significant capital, which can enable businesses to expand operations, purchase inventory in bulk, or invest in marketing initiatives. Loans often come with structured repayment plans, providing predictability in monthly financial obligations, which can aid in effective budgeting and cash flow management. Additionally, the interest paid on business loans is typically tax-deductible, offering potential savings. Securing a loan can also help build a business’s credit profile, making it easier to access future financing under more favorable terms. Moreover, loans can be tailored to meet specific business needs, whether it’s a short-term loan for immediate cash flow relief or a long-term loan for major capital investments. By understanding these advantages, e-commerce entrepreneurs can leverage loans to fuel growth and strengthen their competitive position in the market.

Future of E-commerce Funding

Trends and Innovations

The landscape of e-commerce funding is continually evolving, driven by emerging trends and innovations that offer new opportunities for businesses. One notable trend is the rise of alternative financing options, such as crowdfunding and peer-to-peer lending, which provide access to capital without the need for traditional financial institutions. These platforms harness the power of community and technology, allowing businesses to connect directly with investors. Another innovation is the use of artificial intelligence and machine learning in financial services, enabling more personalized and efficient funding solutions. These technologies can assess risk more accurately and offer tailored recommendations, streamlining the funding process. Additionally, the integration of blockchain technology is paving the way for more transparent and secure transactions, potentially reducing fraud and enhancing trust in financial dealings. As these trends continue to develop, e-commerce businesses can expect a more dynamic and accessible funding environment that supports innovation and growth in increasingly diverse ways.

Boosting Growth Potential

In the future of e-commerce funding, leveraging emerging financial tools and technologies will be pivotal in boosting growth potential for businesses. As digital platforms continue to innovate, they provide more streamlined access to capital, enabling e-commerce entrepreneurs to scale efficiently. Tools like revenue-based financing are becoming increasingly popular, offering flexible repayment options linked to business performance, thus aligning financial obligations with revenue cycles. Additionally, fintech innovations are reducing the friction traditionally associated with loan applications, delivering faster decision-making and fund disbursement. Embracing these advancements can help businesses quickly capitalize on market opportunities, enhancing their competitive edge. Moreover, as consumer behavior increasingly shifts online, e-commerce platforms can utilize advanced analytics to project sales trends, optimize inventory, and tailor marketing strategies, all supported by adaptive funding solutions. By integrating these modern financial approaches, e-commerce businesses can enhance their agility, drive innovation, and capture growth opportunities in an increasingly digital economy.

E-commerce Funding for Newbies

Basics for Beginners

For beginners stepping into the world of e-commerce, understanding the essentials of funding is crucial to launching and sustaining a successful business. Start by assessing your initial capital needs, which include costs for inventory, website development, marketing, and operational expenses. Once you have a clear picture of your financial requirements, explore various funding options. Personal savings or funds from family and friends can be a starting point, but be prepared to look into external financing as your business grows. Traditional loans from banks provide lower interest rates but often require a solid credit history and collateral. Alternatively, online lenders and crowdfunding platforms offer more accessible options with quicker approval times, though they might come with higher costs. Additionally, consider lines of credit for flexible, ongoing access to funds. By understanding these basics, you can effectively navigate the financing landscape and choose the best strategies to support your e-commerce venture.

Choosing the Best Option

Selecting the best funding option for your e-commerce startup involves careful consideration of your business goals, financial situation, and growth plans. Begin by evaluating the amount of capital you need and the timeframe for repayment. If rapid growth and scalability are your priorities, you might opt for venture capital or angel investors, who not only provide funds but also offer valuable industry insights. However, this often requires giving up some equity. For those who prefer retaining full control, traditional bank loans could be a more suitable choice, provided you have a strong credit history and can meet the bank’s requirements. Alternatively, if flexibility is crucial, consider lines of credit, which allow you to borrow as needed without rigid repayment schedules. Peer-to-peer lending platforms and crowdfunding are also viable for beginners, offering community-driven funding with varied terms. Assess the pros and cons of each option to align with your strategic objectives, ensuring sustainable business growth.