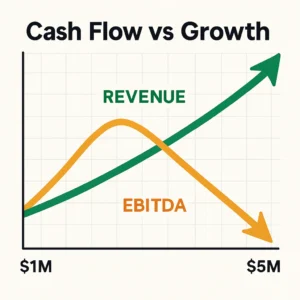

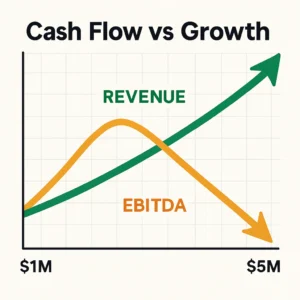

The E-commerce Growth Paradox: Why Scaling to $5M+ Kills Profitability

You’ve built your e-commerce business to $5 million in annual revenue. Your products are selling, your team is growing, and investors are starting to notice. But here’s the brutal reality: you’re probably less profitable today than you were at $1 million.

Sound familiar? You’re not alone.

The Hidden Cost of E-commerce Success

A troubling pattern is emerging among mid-market e-commerce businesses. While many companies in the $2M-$50M range are posting impressive revenue growth, their operational profitability is taking a severe hit. EBITDA margins are shrinking dramatically as businesses scale, creating a painful contradiction between top-line success and bottom-line reality.

This is the e-commerce paradox: the faster you grow, the more cash you burn.

Why Growth Is Eating Your Cash Flow

The Inventory Trap: Success in e-commerce means predicting demand 2-3 months ahead. That holiday inventory? You paid for it in September. Your Black Friday marketing budget? Gone in October. Meanwhile, marketplace platforms like Amazon hold your payments for 14+ days, creating a brutal cash flow gap.

The CAC Spiral: Customer acquisition costs are skyrocketing across all channels. What used to be manageable marketing spend now requires significantly larger upfront investments with uncertain payback periods, especially as iOS changes and privacy regulations make attribution increasingly difficult.

The Scale Penalty: As you grow, your cost structure becomes more complex. You need better systems, more sophisticated inventory management, compliance costs, and specialized talent. These overhead expenses hit your margins hard before new revenue streams mature.

The Control Dilemma: Funding vs. Freedom

Traditional funding advice tells you to “raise capital and scale fast.” But here’s what they don’t mention: venture capital often means surrendering control of your business destiny. Equity investors want board seats, exit timelines, and growth-at-all-costs strategies that may not align with your vision.

Many successful e-commerce founders are discovering there’s a better way.

The Right Capital Philosophy for Sustainable Growth

Smart e-commerce entrepreneurs are adopting a “right capital for the right purpose at the right time” approach. Instead of one-size-fits-all funding, they match specific capital types to specific business needs:

- Working capital for inventory cycles (not 5-year term loans)

- Growth capital for proven marketing channels (not speculative expansion)

- Bridge financing for marketplace payment delays (not permanent debt)

Breaking the Paradox: Smart Capital Allocation

The cash flow vs growth paradox isn’t unsolvable—it’s a signal that you need smarter capital allocation, not just more capital. The most successful mid-market e-commerce businesses are those that understand their cash conversion cycles and choose financing that complements, rather than constrains, their business model.

Your growth shouldn’t come at the expense of your control or your cash flow. With the right financing strategy, you can scale sustainably while maintaining the independence that made you successful in the first place.

The question isn’t whether you can afford to grow—it’s whether you can afford to grow with the wrong capital structure.