In today’s dynamic e-commerce landscape, traditional bank loans aren’t always the best or most accessible option for online businesses. Non-banking loans have emerged as a viable alternative, offering flexibility and accessibility that traditional financial institutions often can’t match. Let’s explore these alternative lending options and how they can benefit your e-commerce business.

What Are Non-Banking Loans?

Non-banking loans are financial products offered by institutions that aren’t traditional banks. These lenders, often called alternative lenders or fintech companies, typically operate online and use different criteria for evaluating loan applications. They focus more on business performance and potential rather than traditional credit metrics.

Types of Non-Banking Loans for E-commerce

1. Online Term Loans

- Fixed amount with regular repayment schedule

- Terms typically range from 3 months to 5 years

- Interest rates from 8% to 30% APR

- Quick application and approval process

2. Peer-to-Peer (P2P) Lending

- Connects borrowers directly with investors

- Competitive interest rates through marketplace dynamics

- Transparent fee structure

- Community-based lending approach

3. Lines of Credit

- Flexible borrowing up to a predetermined limit

- Pay interest only on what you use

- Revolving credit facility

- Quick access to funds when needed

4. Invoice Financing

- Advance payment against outstanding invoices

- Typically 80-90% of invoice value available immediately

- Fees based on invoice amount and duration

- Helps manage cash flow gaps

Key Benefits for E-commerce Businesses

1. Speed and Convenience

- Online application process

- Quick approval decisions (often within 24 hours)

- Digital documentation

- Fast fund disbursement

2. Flexible Requirements

- Less stringent credit requirements

- Alternative data evaluation

- Focus on business performance

- Consideration of online sales metrics

3. Customized Solutions

- Various loan products to match business needs

- Flexible repayment terms

- Scalable funding options

- Industry-specific understanding

4. Technology Integration

- Integration with e-commerce platforms

- Automated repayment systems

- Real-time monitoring

- Digital account management

Qualification Criteria

Basic Requirements

- Minimum 6 months in business

- Regular monthly revenue ($10,000+)

- Basic credit score requirements

- Active business bank account

Documentation Needed

- Business bank statements

- Tax returns

- Financial statements

- E-commerce platform analytics

- Payment processor statements

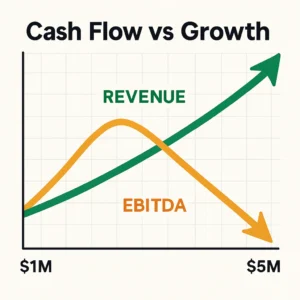

Cost Structure

Interest Rates and Fees

- Annual Percentage Rate (APR): 8-30%

- Origination fees: 1-5%

- Processing fees

- Late payment penalties

- Prepayment terms

Example Cost Calculation

For a $50,000 loan with 15% APR for 12 months:

- Monthly payment: ~$4,500

- Total interest: ~$4,000

- Origination fee (2%): $1,000

- Total cost of capital: $5,000

Best Use Cases

1. Inventory Financing

- Bulk purchase opportunities

- Seasonal inventory preparation

- New product line launches

- Supplier relationship management

2. Marketing and Growth

- Digital advertising campaigns

- Website development

- Market expansion

- Platform integration

3. Operations

- Software implementation

- Warehouse optimization

- Staff hiring and training

- Equipment purchase

Risk Considerations

1. Cost of Capital

- Higher interest rates than traditional banks

- Additional fees and charges

- Impact on profit margins

- Total cost of borrowing

2. Repayment Terms

- Fixed payment schedules

- Impact on cash flow

- Prepayment penalties

- Default consequences

3. Business Impact

- Debt service burden

- Operating restrictions

- Financial covenants

- Credit report implications

How to Apply

1. Preparation Phase

- Gather required documents

- Review business financials

- Prepare business plan

- Calculate loan affordability

2. Application Process

- Complete online application

- Submit documentation

- Verify business information

- Review and accept terms

3. Post-Approval

- Set up repayment system

- Monitor loan compliance

- Maintain communication

- Track use of funds

Tips for Success

1. Compare Lenders

- Interest rates and fees

- Repayment terms

- Customer reviews

- Industry experience

2. Review Terms Carefully

- Read all documentation

- Understand obligations

- Check for hidden fees

- Know your rights

3. Plan for Repayment

- Budget for payments

- Monitor cash flow

- Maintain reserves

- Track business performance

Alternatives to Consider

Before choosing a non-banking loan, evaluate:

- Traditional bank loans

- Revenue-based financing

- Merchant cash advances

- Equipment financing

- Business credit cards

Conclusion

Non-banking loans offer e-commerce businesses a valuable alternative to traditional financing, providing quick access to capital with flexible terms and requirements. While they may come with higher costs than traditional bank loans, their accessibility and speed make them attractive options for businesses needing quick funding or those unable to qualify for conventional loans.

Success with non-banking loans requires:

- Clear understanding of costs and terms

- Strong business fundamentals

- Solid repayment strategy

- Careful lender selection

Remember to thoroughly evaluate your business needs, compare multiple lenders, and understand all terms before committing to any loan product. Consider consulting with financial advisors to ensure the chosen financing option aligns with your business goals and capabilities.