Frequently asked questions

Everything you need to know about finding funding through Turbodash

What is Turbodash?

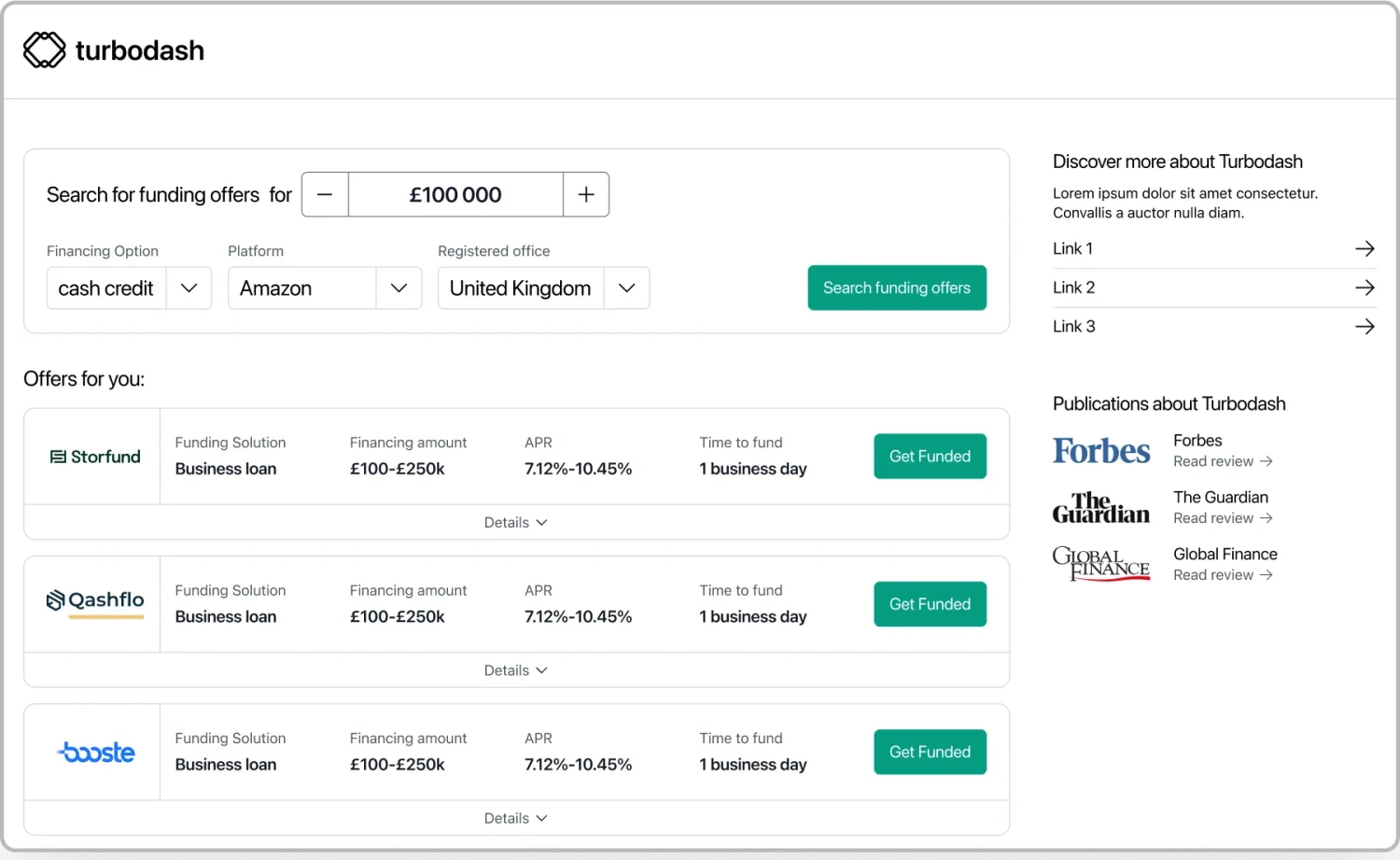

Turbodash is a platform that helps e-commerce businesses find and compare financing options from multiple providers in one place. We simplify the process of securing funding for your business growth.

How does Turbodash work?

We analyze your business metrics and match you with suitable financing options from our network of trusted lenders. You can compare rates, terms, and requirements side by side to make informed decisions.

What are the minimum requirements to apply?

Each funding provider has different eligibility requirements, which is exactly why we created Turbodash. Each funding provider has different eligibility requirements, which is exactly why we created Turbodash. Our platform helps you make an educated decision by transparently comparing:

- Eligibility criteria across providers

- Real APR and total cost of funding

- Time to get funded

We believe in full transparency – you’ll see both the advantages and limitations of each option. This way, you can confidently choose funding that best matches your business needs and capabilities.

Which e-commerce platforms do you support?

We integrate with funding providers who collectively support over 50 e-commerce platforms. This extensive coverage includes major marketplaces and platforms such as:

- Amazon

- Shopify

- BigCommerce

- WooCommerce

- Walmart

- TikTok Shop

- Etsy

- And many more

By partnering with multiple funding providers, we ensure that no matter where you sell, you can find financing options suited to your platform. Each provider may support different platforms, which is why we match you with those that specifically work with your sales channels.

How long does the application process take?

The application and approval process varies between funding providers – that’s exactly why we built Turbodash to help you compare these timelines transparently:

Quick Match (2 minutes):

- Fill in basic business information

- See all available options instantly

- Compare approval timelines side by side

Provider Response Times:

- Same-day decisions (some providers)

- 24-48 hour approval process (most common)

- Up to 5 business days (for larger amounts)

Time to Receive Funds:

- As fast as same day after approval

- Typically 1-3 business days

- May vary based on funding amount and type

By displaying these timelines upfront, you can choose a provider that matches your urgency – whether you need immediate funding or prefer a more thorough process with potentially better terms.

💡 Tip: Having your business documents ready (bank statements, marketplace performance data) can significantly speed up the approval process with any provider.

Is my data secure?

Yes, we implement industry-standard SSL encryption to ensure secure communication between your device and our application. All data transmitted to our platform is protected during transfer. We maintain strict access controls and handle your data in compliance with data protection regulations. Our privacy policy details exactly how we collect, use, and protect your information.

What types of funding are available?

We offer various funding options including merchant cash advances, term loans, revenue-based financing, and working capital loans.

How much funding can I get?

Funding amounts vary significantly between providers, which is why Turbodash helps you compare all available options based on your business metrics.

Key Factors Affecting Your Amount:

- Monthly revenue

- Time in business

- Platform performance

- Sales history

- Seasonal patterns

- Current financing

Using Turbodash, you can:

- See your maximum eligible amount across all providers

- Compare different financing types side by side

- Understand what impacts your funding limits

- Find providers who can scale with your growth

💡 Tip: Many providers offer the ability to increase your funding amount or access additional rounds of financing as your business grows and establishes a positive payment history.

How much does it cost?

Funding amounts vary significantly between providers, which is why Turbodash helps you compare all available options based on your business metrics.

Key Factors Affecting Your Amount:

- Monthly revenue

- Time in business

- Platform performance

- Sales history

- Seasonal patterns

- Current financing

Using Turbodash, you can:

- See your maximum eligible amount across all providers

- Compare different financing types side by side

- Understand what impacts your funding limits

- Find providers who can scale with your growth

💡 Tip: Many providers offer the ability to increase your funding amount or access additional rounds of financing as your business grows and establishes a positive payment history.

Ready to boost your e-commerce?

Discover your financing options, absolutely free.

Explore tailored options and gain valuable insights into your funding potential without any commitment or cost.

We're here to help with any other questions

Can’t find what you’re looking for in our FAQ section? Our dedicated team is ready to assist you with any additional questions about our platform, services, or anything else you need to know.